Harvey and the Reddit Thread: The Actually Useful Takeaway

Also in this episode: Zach goes on a rant.

Hey there, I’m Zach Abramowitz and I’m Legally Disrupted. Do you know what I’m not? Paid by Harvey.

**Note to Readers: critical rant incoming. If you want to skip down to where I talk about the Reddit thread, I won’t be deeply insulted. But, just know you’re missing out.**

</START RANT>

I feel like I need to make this clear because a number of people have asked me directly whether I’m getting paid by Harvey or if I have some relationship with them. When I’ve mentioned it to others in my network, their reaction is usually “Yeah, I thought that too, but I didn’t want to say anything.” My guess is that some of you have come to that conclusion as well.

So, let me be quite plain: I don’t get paid by Harvey. I have never been paid by Harvey. I own zero stock in Harvey or any SPVs that have invested in Harvey.

The fact that I’m not on the dole from Harvey is important, in particular, for today’s dose of legal disruption because I’m going to get into the now vaunted Reddit thread in which someone purporting to be a recently fired Harvey employee decided to go nuclear (the post has since been deleted). In the course of discussing the content of that thread, I might end up defending or, Heaven forefend, even saying something nice about Harvey. But, I need to go on this rant not just over the Reddit thread but because it is fundamental to the Killer Whale Strategies business model.

I’m an aligned incentives extremist. I never want clients wondering if I’m recommending a tool because I get a kickback. Early in my career I tried referrals, and it felt queasy and totally off-brand for what we do now at KWS. Our value is often in saying the hard-to-hear stuff, and that only works if clients know we’re focused solely on their long-term success.

That said, to be in the dealmaking business, you need some skin in the game. That’s why I invest my own personal money in legal startups. It signals confidence, shows clients I understand what’s coming, and gives me insight you can’t get from the outside.

Sometimes I recommend portfolio companies to clients — but only when the ROI is undeniable. Other times I don’t. And the value I provide to clients has actually increased because I see both sides of the table: the Davids and the Goliaths. That dual empathy makes me a better advisor.

Furthermore, the value we provide to clients has increased dramatically from my experience as an operator-investor. Investing in and helping startup founders is like the gym work that gives me an edge on the field of client services. By sitting on all sides of the table and getting into the weeds with a handful of top teams, I’m able to get unique insights about the ecosystem. It’s given me a kind of two-sided empathy, and that’s made me a better dealmaker and strategic advisor. I understand the mindset of the Davids and Goliaths because I work with both.

The only startups I have ever worked with on retainer are the ones with whom I’ve invested, and that’s only after a cool off period following my initial investment. Every startup CEO I invest with will tell you that as part of my investment with them, I give them strategic counsel and coaching, not just after I invest but while I’m evaluating them.

And I don’t charge them anything for it.

During the evaluation process, I open doors for them with clients for whom there could be a fit. KWS clients see this is a major value add, because it often means they’re seeing hot companies before the rest of the market. In some cases, these intros have led to huge deals for both sides. I introduced Baker McKenzie to SparkBeyond before they launched an exclusive partnership; I helped TermScout secure investments from James Currier at NFX and David Stark at Ground Up Ventures; I introduced LegalMation to one of their first major automotive OEMs (they have since secured deals with more than half of the big automakers). I could go on.

In some instances, portfolio companies will ask me to dedicate more time and attention to helping them win. When the opportunity makes sense, we will do that, often in exchange for more equity, but sometimes cash. We will NEVER do it on commission. There are tech and companies outside my portfolio (but almost always mature companies) that engage us to brief them periodically throughout the year on the key trends we are seeing in the market. Harvey has done neither.

In previous newsletters, I have said unequivocally that I had never spoken with anyone from Harvey, and I even admitted to being “butt-hurt” re: the non-reach-out. In the last year, I have spoken with people from Harvey, but we’re just friends. But, listen, I am not shy. Trust me, if I had invested in Harvey, you’d know about it from my nonstop flexing. Not only do I not work for Harvey, but on at least one occasion I introduced the Legora team to a Harvey customer, hosted Legora’s head of community Chris Williams on my podcast and have plans to do the same with Max Junestrand (although we’ll have to see after this newsletter ). Plus, I’ve specifically looked at investing in companies I believe can compete with both Harvey and Legora. There are more than a few.

As a broader cultural point, we’ve become suspicious of anyone who takes a spicy position online. And, to be fair, I’ve definitely not been vanilla in my Harvey takes. I’ve written newsletters indicating that Harvey was, well, kind of awesome (something I still believe). But, in my defense how can you not be in awe of a three year old startup generating over $100M in ARR and $5B valuation based on investments from some of Sandhill road’s finest, all while making inroads with customers that were previously impenetrable for startups? That would have been impressive in its own right, but it’s even more impressive that the founders were a couple of guys in their 20s who had never launched a startup, and the one who was supposed to be the “domain expert” had only worked for six months in Biglaw.

So what do I think about Harvey?

I admire Harvey as a company and, yes, even have a bit of FOMO: I didn’t come up with the idea myself and that I didn’t invest in their seed round. For someone who’s as active in the space as I am, it was a real miss on my part. I think Harvey is a force with which to be reckoned. They have real vulnerabilities, but I think there is a strategy in place to address those vulnerabilities. Even the Death Star had that one spot.

This is one of those “Two things can be true at the same time” scenario. I can be both in awe of Harvey, as well as deeply on the lookout for the next Harvey, including investing with credible competitors, of which I believe there are a few.

I can even write these opinions publicly without Harvey being the Qatar to my Tucker Carlson.

</END RANT>

Breaking down the Reddit thread.

Now, as far as the r/legaltech thread goes, there’s the actual content of the post, which I think is less interesting, and the reaction to the post, which I think is the real story here. So, that’s what I want to address first.

Harvey sparks some strong emotions.

Harvey gets people talking. That’s what a powerful brand does. You saw that in this instance for sure. Everyone on LinkedIn felt compelled to weigh in on this all-important AMA, as if they hadn’t just learned ten minutes ago that r/legaltech is even a thing.

Our team read the thread, but that’s because my partner Nina reads every single r/legaltech thread, despite her complaint recently that it’s become way too salesy. I honestly didn’t make much of it at first. This isn’t the first time that r/legaltech commenters dunked on Harvey (as well as other vendors).

So, now, let’s do the following mental experiment. Imagine for a moment that the r/legaltech thread had been about Legora, instead of Harvey.

Do you think every Legal Innovation Linkedfluencer would be hot-taking all over themselves to explain why they felt obligated to share their perspective on this all important thread?

Methinks not.

The Reddit thread is a byproduct of a strong brand, with some real kick.

Here’s the real story: Harvey has become the Dallas Cowboys of AI for Legal. The Cowboys are the iconic team so many love, and even more love to hate. All that energy gives the Dallas Cowboys their $13B value, $2.5B more than the next team that you don’t care about because they’re not the Dallas Cowboys.1 It doesn’t matter that they haven’t won the most Super Bowls or that they don’t have the newest stadium, their brand makes them the most valuable franchise in American sports. Given Harvey’s Dallas Cowboys vibe, it’s no surprise that they are valued more than 5x their closest competitors.

For years, ESPN’s Skip Bayless (another polarizing brand) built his audience on this dynamic. I worked at ESPN during Law School, and, amongst the other talking heads, Skip was easily the most polarizing on-air personality. But his audience made him one of the highest paid pundits both at ESPN and later at Fox. His genius was realizing two simple truths:

Fans either love the Cowboys or hate them.

What fans loved, and what haters couldn’t stand, was how much extra attention the Cowboys got.

So Skip gave them both exactly what they wanted: more Cowboys talk. He didn’t mind being hated, as long as there was love in the mix.

The reason I write about Harvey so much, is because that’s what you want to hear about, whether or not you love them or hate them (yikes! does that make me Skip Bayless of legaltech?). When I speak to lawyers and VCs, they both ask me about Harvey. When I write about Harvey, everyone shares it (as some of you surely will share this insanely long newsletter). I noticed this for the first time when my podcast with Edward Bukstel about whether Harvey was overhyped, quickly became my most downloaded episode. At this year’s ILTACON, the session on Harvey was quite literally standing room only and had the palpable buzz of a real media event. I’ve never seen anything like that at legaltech events. Legaltech has never had a brand that drove this much engagement. We’re bigtime now.

And, like the Cowboys, iconic brands can be divisive. They can even platform competitors. Almost every firm I know that has chosen Legora has mentioned to me that they were getting pressure to buy Harvey, but couldn’t stand the thought of working with “those guys.” By the way, that’s totally reasonable. But, it indicates that one of the most important reasons to buy Legora is (1) Harvey exists and (2) Legora isn’t Harvey. I think they understand this too, and it would explain why they would change the company name from Leya to Legora. Rather than have a name that puts you in the same box as Harvey, be as different from Harvey as possible.

I am willing to bet that every firm decision maker that went with Legora has been sharing the Reddit thread internally. Because, what validates their decision is not that Legora is awesome (which I’ve heard it is btw), but evidence that Harvey is now tainted.

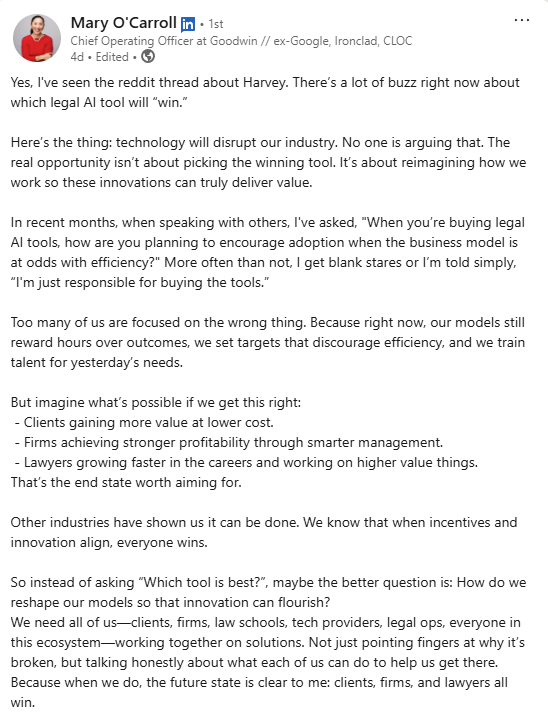

Take Goodwin for example. Earlier this year they announced they were going with Legora, with Mary O’Carroll as the spokesperson on the release. Fast forward to her more recent LinkedIn post where, instead of talking up Legora, she pointed at Harvey and the Reddit thread.

That’s the dynamic I’m talking about and Mary, who is quite clever, knows what she is doing. Firms don’t validate their decisions by saying, “look how great Legora is.” They validate them by saying, “Look at Harvey’s shortcomings, aren’t we smart for holding out for a better option?” That’s not because there’s something wrong with Legora, it’s because Harvey is in everyone’s heads just that much.

Okay, but what about the actual claims made in the Reddit post?

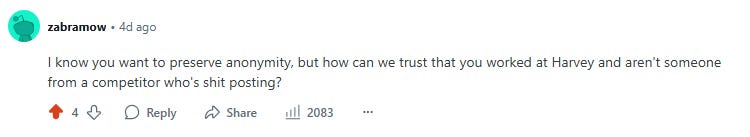

The Reddit post itself didn’t tell us anything new. It was catnip for Harvey-haters: Harvey = ChatGPT, buyers regretting it, juniors are the only users (this is straight bull$%it btw), toxic culture. Here’s the reality: usage varies by firm, sure, and working at Harvey is no one’s model of work-life balance — but that’s true of every successful hyper-scaler. The real point is: the haters just heard what they wanted to hear. That’s why I was skeptical that this person actually worked at Harvey.

The lesson from Harvey is that to win in the age of AI, you need to develop a core insight about your market — what Peter Thiel calls the contrarian take — plus an iconic brand that lands with your customers. Harvey has that in spades, and not just because they have a great name or a pretty logo. Harvey understood that, at least at first, AmLaw 200 firms and their biggest clients were not going to want the standard consumer ChatGPT, they were going to want a special-made-for-lawyer model. That doesn’t necessarily make firms rational. As an example, I was advising firms at the time to just sign up for an enterprise plan with OpenAI. Today, everyone has realized was probably the right direction to go two years ago. But, at the time, they wanted something professionally customized and that’s become table stakes for most big firms. Harvey’s team understood how to message and design for that. And they’re reaping the rewards.

The power of harmonizing core insight, product design and brand.

Harvey hasn’t necessarily been winning deals on their tech. Harvey has been winning deals on their execution on brand and product design, which are really two sides of the same coin. To the r/legaltech shitposter’s point, how much difference is there really between Harvey and ChatGPT? But I think that misses the point. Drink Coca-Cola from an off label bottle, and tell me if it makes you feel the same.

By onboarding top firms, raising a war chest from the likes of Sequoia and Kleiner Perkins and making the decision makers at Harvey-adopting firms look like pioneering innovators, Harvey created a permission structure for sophisticated lawyers to use AI, and the Harvey team embedded that in every part of their brand.

Did they really need all that money just to build an application layer product? Probably not. But they’re selling more than their product. They are selling the idea that AI is fast moving, things are going to change and you’re going to need a partner to power you through that transformation. They are telling customers, we’re going to have to pivot, budget for compute and acquire other players along the way. But customers can rest assured because Harvey has the resources to do all of that and more, as do their backers who are the most trusted names in Silicon Valley. They are telling firms, ride with us.

Here’s another place where extra capital will come in handy: some firms are going to cut ties with Harvey. They’re going to look at their modest usage stats and decide to replace it with ChatGPT or they’re going to prioritize other products whose ROI shows up more clearly on a P&L. This will likely create a herd mentality where other firms cut bait with Harvey. This will happen to other products as well. Does that mean the company will go bust? No. I would still bet on them to be the clear leaders in Biglaw and Fortune 500 legal departments one year from now.

What can startups and incumbent firms learn from Harvey and “r/legaltech-gate?”

If your takeaway, then, is that Harvey is vaporware or Legal AI Theranos, you’re going to be disappointed. And you’re going to miss out on the more important takeaway that is deeply pressing to both incumbent law firms and startups.

So many of the companies we are working with right now, whether it is firms, service providers and tech companies, have been moved by the AI revolution to reevaluate their organizational structure, their services and, yes, their brand. There is a major shift taking place right now which is going to impact just about every professional services business. Disruption will create new opportunities for firms to capture business from their competitors as well as capitalize on new opportunities in an economy that is changing rapidly. That realization has them breaking and redesigning, in some cases from scratch. The challenge is that everyone has access to the same underlying models. So, therefore, the winners will be those who move first, develop key insights about their clients and execute on a brand and design that lands with their target users. Even if it means getting a healthy dose of hate along the way.

Okay, it’s the Rams. See? I was right.